Leave Your Message

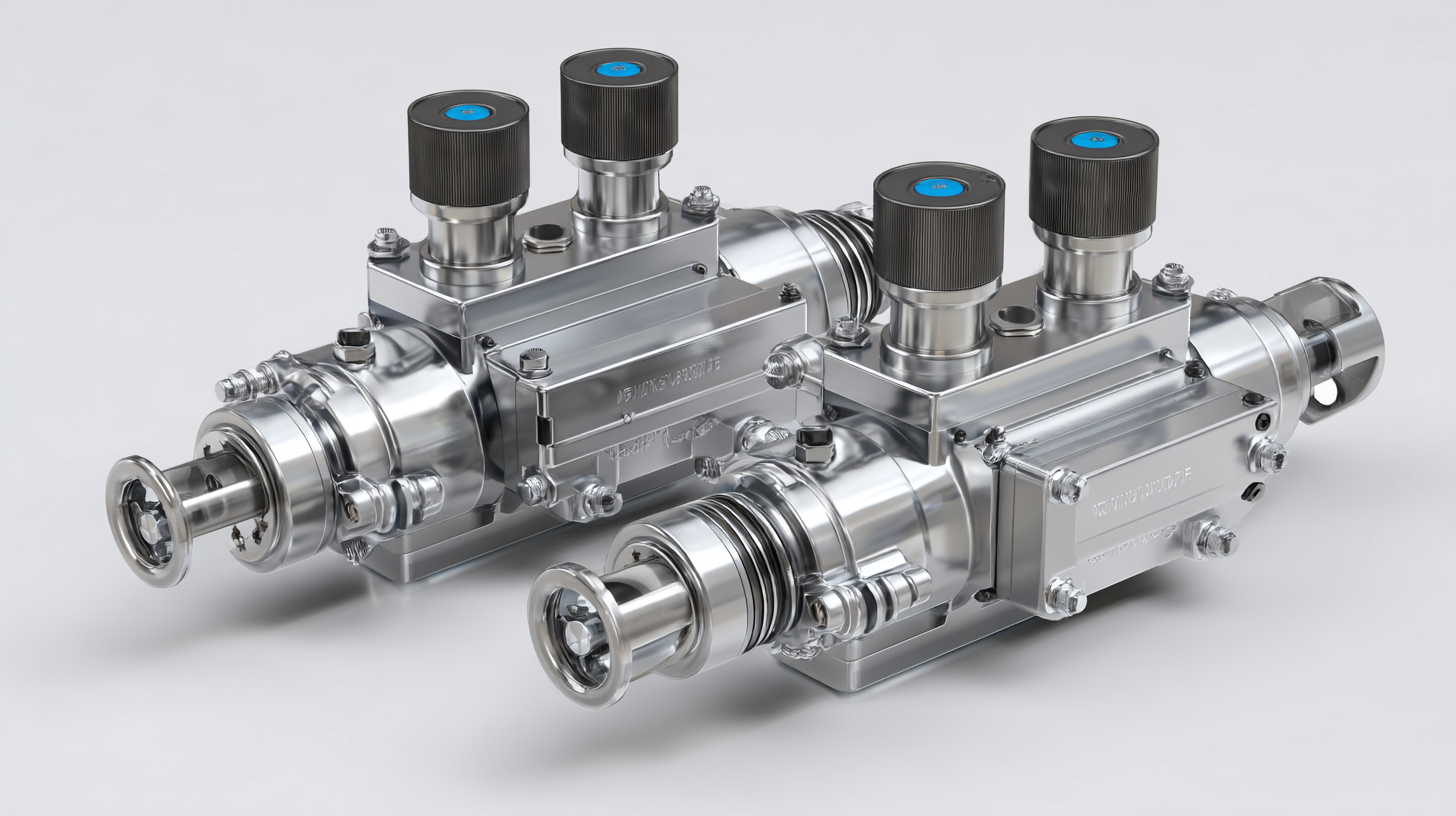

In today's fast-paced industrial landscape, sourcing high-quality components is crucial for businesses seeking to maintain a competitive edge. Among these essential components are Directional Logic Element Valves, which play a vital role in fluid control systems across various applications.

As global buyers increasingly turn to China for these innovative solutions, understanding how to identify reliable and high-quality suppliers becomes paramount. This blog aims to provide insights into the key criteria for evaluating potential suppliers of Directional Logic Element Valves, helping buyers navigate the complexities of the supply chain in a market saturated with options.

From assessing manufacturing standards to analyzing customer support, finding the right partner can significantly impact operational efficiency and product performance, ensuring that your projects meet both safety standards and performance expectations.

As global buyers increasingly turn to China for these innovative solutions, understanding how to identify reliable and high-quality suppliers becomes paramount. This blog aims to provide insights into the key criteria for evaluating potential suppliers of Directional Logic Element Valves, helping buyers navigate the complexities of the supply chain in a market saturated with options.

From assessing manufacturing standards to analyzing customer support, finding the right partner can significantly impact operational efficiency and product performance, ensuring that your projects meet both safety standards and performance expectations.

As technology continues to evolve, the future of directional logic element valves is set to be significantly transformed by emerging innovations by 2025. These valves, critical for controlling fluid flow in various applications, are witnessing the integration of advanced materials and smart technologies. Innovations such as additive manufacturing are allowing for the production of more complex geometries, resulting in increased efficiency and reduced weight. Such advancements not only enhance performance but also open the door for customization to meet specific operational needs.

Moreover, the rise of the Internet of Things (IoT) is poised to revolutionize how directional logic element valves operate within systems. By incorporating smart sensors and connectivity features, these valves can provide real-time data on performance and condition, aiding in predictive maintenance and reducing downtime. This connectivity empowers manufacturers and operators to optimize their workflows, thus increasing overall productivity. As these technologies mature, we anticipate a robust demand for China-made directional logic element valves that leverage these advancements, solidifying China's position as a leader in the global market.

As the global demand for instrumentation valves and fittings continues to surge, the market is projected to showcase a remarkable compound annual growth rate (CAGR) of over 9.4% from 2025 to 2032, with revenues anticipated to surpass USD 7.05 billion. This growth reflects the increasing reliance on precise control mechanisms in various industrial applications, driving innovations in manufacturing processes, especially in China.

In 2024, significant technological breakthroughs in China’s key equipment sector have paved the way for advanced manufacturing techniques that enhance production efficiency and product quality. Collaborative innovation within the machinery industry has been instrumental in developing homegrown technologies. With China producing approximately 70% of the world's lighters from a single county-level city, it exemplifies how localized production and innovation can meet global market needs effectively. Such advancements not only elevate China’s status in the manufacturing domain but also facilitate the introduction of cutting-edge solutions to global buyers seeking reliable and efficient directional logic element valves.

This chart represents the distribution of market share for China-made directional logic element valves among different regions globally in 2023. The data reflects the expanding influence of Chinese manufacturing in the valve market.

Sustainability is becoming a critical focus in the manufacturing sector, particularly for directional logic element valves. As industries worldwide transition towards more eco-friendly practices, manufacturers in China are adopting innovative techniques that minimize waste and energy consumption. The integration of sustainable materials and the implementation of efficient production processes not only contribute to environmental protection but also appeal to global buyers who are increasingly prioritizing sustainability in their procurement decisions.

Moreover, the growing trend of circular economy principles is reshaping the production landscape of directional logic element valves. Manufacturers are now exploring ways to enhance the recyclability of their products, encouraging a lifecycle approach that reduces environmental impact. This shift not only meets the regulatory demands but also positions companies to gain a competitive edge in a market that values sustainability.

By embracing these trends, Chinese manufacturers are leading the charge in providing high-quality, eco-conscious directional logic element valves to customers around the world, ultimately fostering a more sustainable industrial future.

The automotive valve market is poised for significant growth, with projections indicating a value of $1,117.2 million by 2025 and a compound annual growth rate of 1.8% leading up to $1,288.6 million by 2033. This growth is largely driven by the increasing demand for innovative valve solutions that cater to a diverse range of applications, particularly in the electric vehicle sector. The upcoming 14th Shanghai International New Energy Vehicle Technology and Ecological Chain Expo, scheduled for August 13-15, 2025, will provide a vital platform for industry players to showcase such advancements and connect with global buyers.

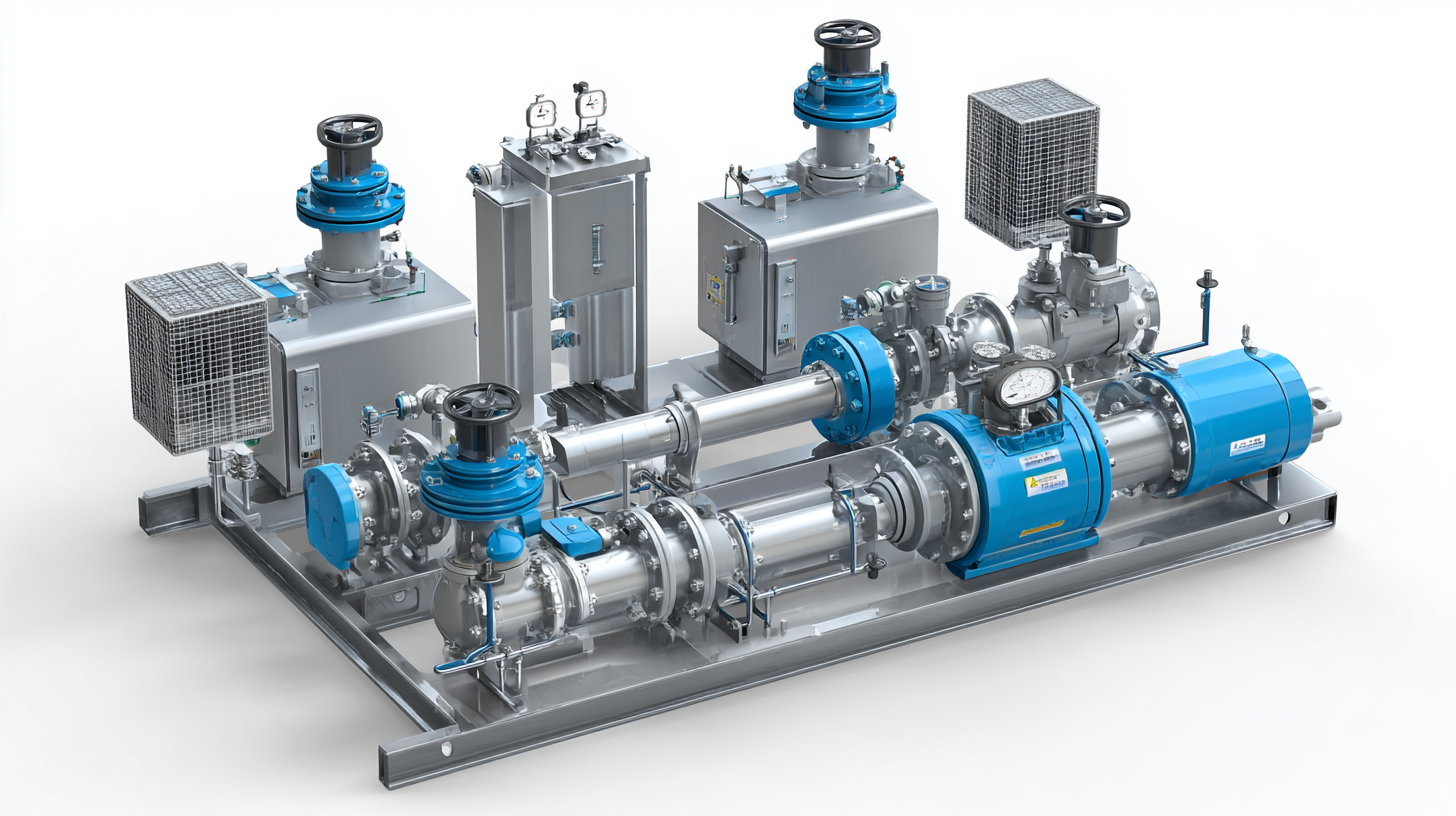

Moreover, advancements in valve remote control systems are expected to further enhance market dynamics. The valve remote control systems market is estimated to exceed $8.6 billion in 2024, anticipating a robust compound annual growth rate of 6.5% through 2034. This growth is fueled by heightened safety regulations and an urgent need for efficient leak isolation. As industry stakeholders gather at major events like the Shanghai expos, the exchange of cutting-edge innovations will be crucial in meeting the evolving demands of global buyers in the years to come.

When selecting the right directional logic element valve, it's crucial to consider several key factors that align with your specific operational needs. According to a recent industry report published by MarketsandMarkets, the global market for directional valves is projected to reach $5.8 billion by 2026, driven by the increasing demand for automation and efficient fluid control systems. Understanding the different configurations, such as poppet or spool designs, is essential as each serves unique applications and performance specifications.

Tips: Always assess the operating conditions, including pressure, temperature, and fluid type, to ensure compatibility. Additionally, evaluate the valve's response time and flow characteristics to match your system’s requirements.

Another vital aspect to consider is the manufacturer’s reputation and the valve's reliability. A reliable valve reduces the chances of downtime and repairs. Researching certification standards, such as ISO 9001, can provide insights into a manufacturer’s commitment to quality management. A report by Allied Market Research highlights that quality assurance in valve production can significantly increase lifespan and operational efficiency, reinforcing the importance of choosing a reputable brand.

Tips: Opt for valves with a proven track record in your industry and consider customer feedback as part of your evaluation process.